Financial vocabulary plays a crucial role in our everyday lives, whether we are managing our personal finances or working in the finance industry. It is essential to have a good grasp of these terms to make informed decisions and communicate effectively in the financial world.

Whether you are a student looking to improve your financial literacy or a professional working in the finance sector, understanding financial vocabulary is key to success. From basic terms like ‘interest rate’ to more complex concepts like ‘hedging,’ having a solid understanding of these terms can help you navigate the financial landscape with confidence.

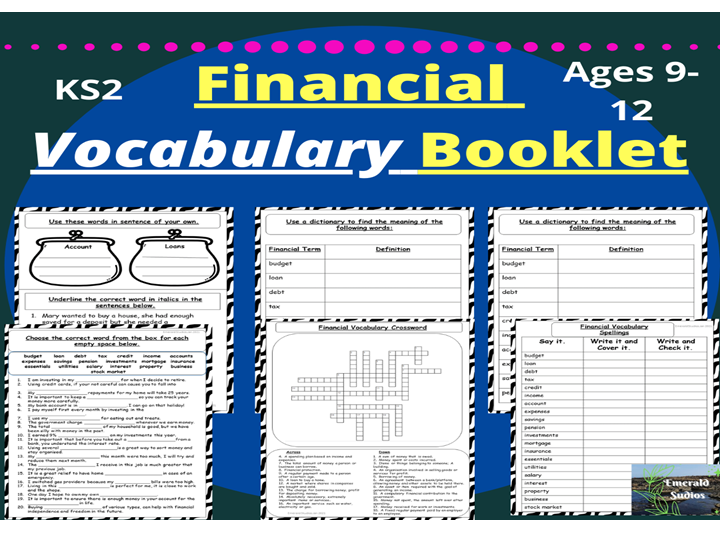

Financial Vocabulary

1. Compound Interest: This is interest calculated on the initial principal as well as the accumulated interest from previous periods. It can significantly increase the amount of money you earn or owe over time.

2. Asset Allocation: This refers to the distribution of investments across different asset classes such as stocks, bonds, and cash. It is a crucial strategy to manage risk and maximize returns.

3. Liquidity: This term refers to how easily an asset can be converted into cash without affecting its market price. Assets like stocks and bonds are considered liquid, while real estate may be less liquid.

4. Net Worth: This is the difference between an individual’s assets and liabilities. It is a measure of one’s financial health and can help determine overall financial stability.

5. Dividend: This is a payment made by a corporation to its shareholders as a distribution of profits. Dividends are typically paid out regularly and can provide a source of income for investors.

Having a good understanding of these terms and others in the financial vocabulary can empower you to make better financial decisions, whether it’s managing your investments or planning for retirement. By familiarizing yourself with these terms, you can communicate effectively with financial professionals and navigate the complex world of finance with confidence.

In conclusion, financial vocabulary is an essential tool for anyone looking to improve their financial literacy and make informed decisions. By learning and understanding these terms, you can take control of your finances and achieve your financial goals with greater confidence and success.